haven't filed taxes in 5 years what do i do

But if you filed your tax return 60 days after the due date or the. Overview of Basic IRS filing requirements.

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

Then you have to prove to the IRS that you dont have the.

. Input 0 or didnt file for your prior-year AGI. This helps you avoid prosecution for. Underpayment penalty 05.

If youre late on filing youll almost always have to contend with these two penalties. That said youll want to contact them as soon as. Bestselling Learn Guitar on Android.

The federal tax return filing deadline for tax year 2021 was April 18 2022. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available.

Failure to file penalty 5 of unpaid tax per month. You are only required to file a tax return if you meet specific requirements in a. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

Contact the CRA. Some tax software products offer prior-year preparation but youll have to print. Then start working your way back to 2014.

Failure to file and pay taxes is a serious issue with the IRS which can result in severe penalties said Jodi Cirignano a. Ive worked in three restaurants and I sold Cutco for a year and then ran an office and. If you missed the deadline and did not file for an extension its very important to file your taxes as.

Havent Filed Taxes in 5 Years. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. Then you have to prove to the IRS that you dont have the means to pay.

If you fail to file your taxes youll be assessed a failure to file penalty. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. The deadline for claiming refunds on 2016 tax returns is April 15 2020.

Havent Filed Taxes in 10 Years. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. 16 votes 12 comments.

The penalty charge will not exceed 25 of your total taxes owed. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure Program as soon as possible. I havent filed my taxes since 2009.

This penalty is usually 5 of the unpaid taxes. Most taxpayers are required to file a tax return each year.

Haven T Filed Taxes In Years What You Should Do Youtube

What To Do If You Haven T Filed Taxes In Years Youtube

Haven T Filed Your Taxes Here S What You Need To Know Youtube

/will-i-pay-tax-on-my-home-sale-2389003-v5-73871af4e690411c8fc3e03de02cb241.png)

Will I Pay Taxes When I Sell My Home

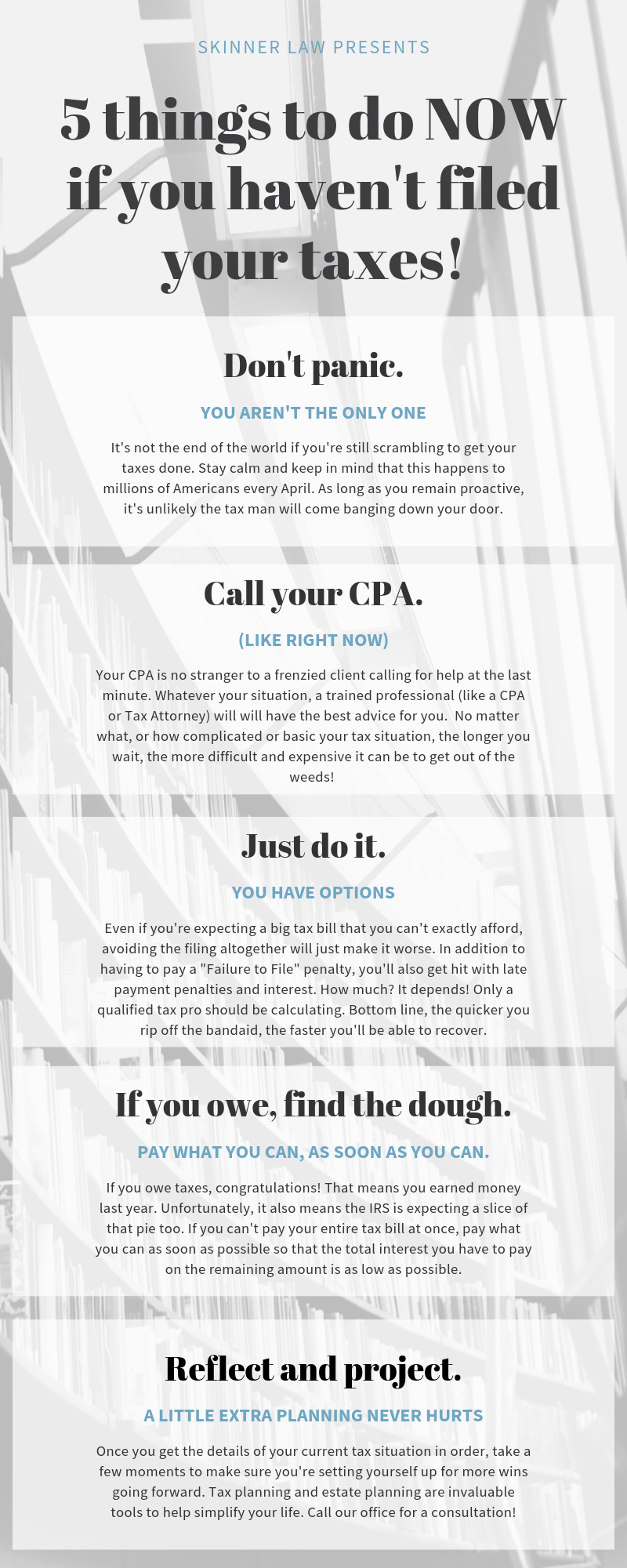

5 Things To Do If You Haven T Filed Your Taxes Infographic

5 Things To Do If You Haven T Filed Your Taxes Infographic

What To Do If You Haven T Filed Your Taxes In Years

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

How To File Your Taxes In 5 Simple Steps Ramsey

What Happens If You Don T File Taxes For Your Business Bench Accounting

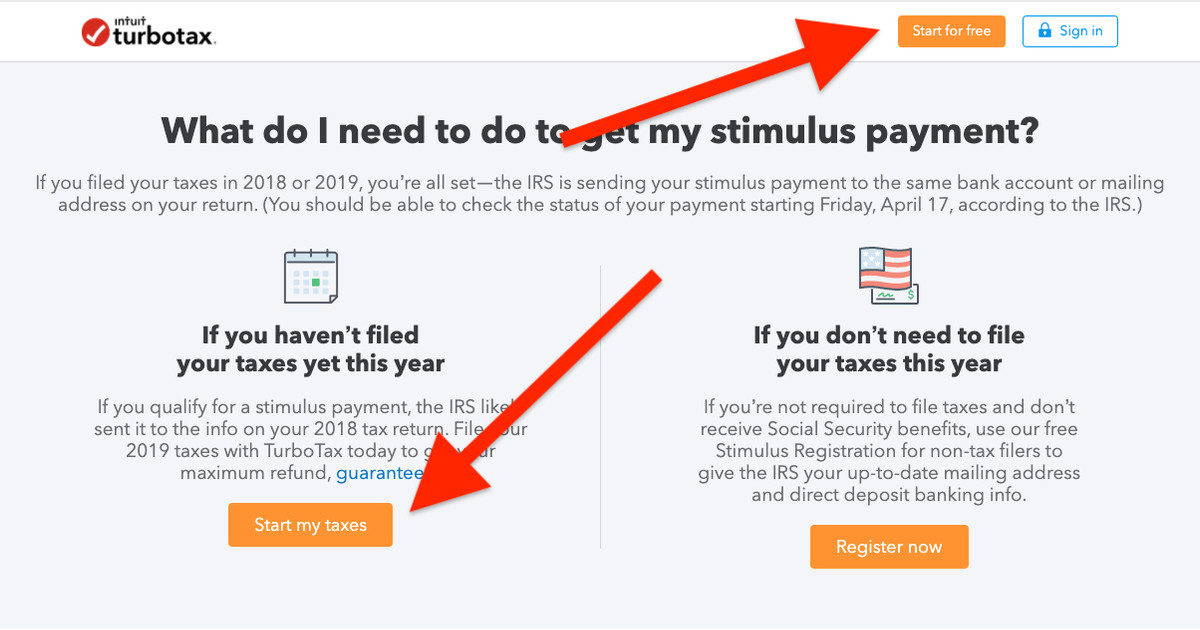

How Do I File Returns For Back Taxes Turbotax Tax Tips Videos

I Haven T Filed Taxes In 5 Years How Do I Start

Unfiled Tax Returns Guidelines And Info On Filing Tax Returns Late

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

Millions Of Americans Might Not Get Stimulus Checks Some Might Be Tricked Into Paying Turbotax To Get Theirs Propublica

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Where S My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You Cnet

Pix11 News On Twitter It S Tax Day The Federal Deadline For Individual Tax Filing And Payments And The Irs Expects To Receive Tens Of Millions Of Last Minute Filings Electronically And